| |

Spiral of decline

10 January 2014 • Ype Wijnia

asset management strategie, risk management, policy development, planning

The new year did only begin or is it time to increase the revelry with the spiral of decline. No, this is not the newest attraction of a roller coaster park and no, it is not an appropriate time of the year to spread the nostalgia feeling that everything used to be better in the past. The spiral of decline is a phenomenon that could surprise even an observant asset manager. The ominous phenomenon is also known under the name of vicious circle or runaway, but the signal theorists among you, of course, know it involves positive feedback.

Now many will wonder why we call positive feedback ominous. In previous columns, we probably wrote that you should appreciate staff when they do something good, which is also sometimes interpreted by HR mafia as giving positive feedback. For the record, we have never used this ourselves and use positive feedback only in the negative sense. We will explain briefly.

It is positive feedback when a phenomenon holds itself in position with his own consequences. The most famous example is making money with money. You put an amount in the bank (make sure you pick the right one), and you then get a small fee for the provision of that money, also called interest. In general, the bank does not compensate the returns in cash, but puts adds it to the same account. Therefore you get a little more the next year, and so on and so forth. A fee of 5% per year will double your money roughly every 14 years as long as you stay away from it. So after 14 years, you get paid the same amount of interest on the accrued interest as of your originally invested money, without you have to do something for it other than stay away from your money.

This sounds nice, but unfortunately it also works in the other direction. You borrow money to buy a particular product and then you borrow money to pay the interest. Also for the interest on this additional loan you take out a loan, and so on and so forth . Sounds crazy? Yet this was reality of the housing market in the US for the financial crisis, where people with no income, employment or capital (the so-called NINJA loans, No Income, No Job or Assets) could close a mortgage with the assumption the value increase of the houses was higher than the additional amount which had to be borrowed to pay the interest. That went well until house prices dropped, so the whole house of cards collapsed [1].

Also in the non-financial asset management these kind of destructive spirals appear. In the chemical industry for example, the processes usually take place in closed reaction vessels, because there the optimal conditions of pressure and temperature can be maintained. If the reaction produces heat, this must be disposed of in cooling since otherwise it will heat up the case and the reaction no longer takes place under optimal conditions. Chemical reactions only have the snag that they increase in speed when it gets warmer. The heating of the reactor vessel will thus lead to a greater production of heat due to which more warming occurs. In linear systems this is not so bad, then a new equilibrium point will be found. Unfortunately, most reactions double in speed per 10 degree temperature rise, but the heat transfer will not. This means that the temperature rise is accelerating until the whole thing collapses with great violence. Find out yourself on the internet with chemical explosion, runaway or BLEVE.

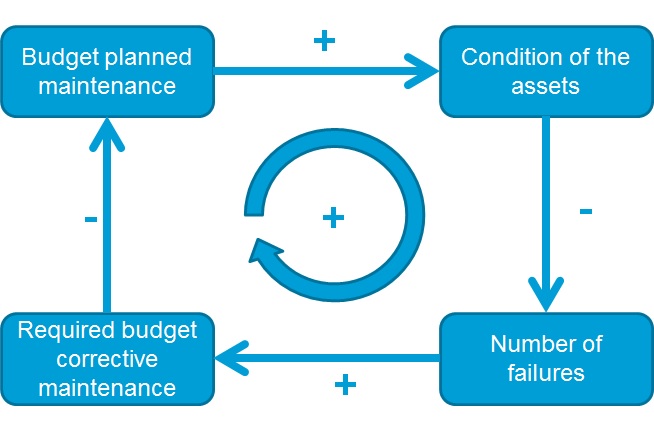

Yet another example, but now in the maintenance business in which the spiral or decline occurs. Which technical asset manager never started a maintenance job that led to more maintenance? You start for example with a frame of a window from which the paint is dull, but while sanding the old paint you find out that there are rotten spots in the wood. Rotten wood cannot be painted so that must be addressed first, but unfortunately the rotten parts are not only on the surface of the wood so that a filler is not suitable. A new frame is required, and what a surprise, despite the rotten parts the frame avoids a crack in the wall, which you sadly just discover when you remove the frame in order to fix it. So you end up that you can rebuild the house, while at first only the paint was dull. At the system level the spiral of decline is actual as well. Corrective maintenance is more costly (in time, costs and damages) than planned maintenance. If a lot more corrective maintenance is needed than expected, the budget for planned maintenance will come under pressure. However less planned maintenance will again result in more failures, putting the budget under further pressure, and so on. This is shown in the figure.

What the big problem is with the spiral of decline is that there is no escape once you get inside. The only thing you can do is to wait until another force stops the spiral, though that can be unpleasant. It seems one has to avoid getting in it at all times. Speaking in system terms it means that you have to stay below the critical value, in plain language you require a wide margin. But overall is this the best solution? A safety margin costs money, and this has to be saved with the avoided risk. Beyond that, 100% risk free does not exist, so even with a very large margin of safety it is still possible that the same effect occurs, perhaps not due to the spiral of decline but just by external calamities like storms, earthquakes, volcanic eruption and / or tidal waves. If the likelihood of such events is as large as the spiral of decline, then it does not seem sensible to continue with improvement.

Not everyone agrees otherwise. The difference is that you could have done something to prevent the spiral of decline, but not to the disaster, and because you could do something you should have done so. The latter argument sounds attractive and is also known as the precautionary principle, which means that you do not take measures when you are not certain if it is safe to do so. Yet in our opinion there is a strong fallacy in that principle. If you're avoiding all potential risks, you actually can do nothing. And besides, the exposure to an external calamity is also a choice and thus apparently an accepted risk.

For the spiral of declines perhaps there should be more thinking about ways of stopping the spiral. We already mentioned that this only happens when there is a large external force, but what if you stir that power yourself? The runaway explosion of a chemical plant can be prevented by blowing the reactor preventatively with some dynamite. A drastic measure, but a controlled explosion is usually less severe than an uncontrolled one. And the collapse of a house by poor maintenance can be prevented with a proper amount of explosives. To speak with Jamie Hyneman [2]: "If everything else fails, use C4". Fortunately we have some fireworks left from New Year's Eve . Let's see where we can put that effectively against positive feedback.

[1] For a more detailed description of the madness we can recommend Michael Lewis in The Big Short.

[2] Jamie Hyneman is one of the presenters of mythbusters, a program in which commonly accepted truths and myths are tested scientifically. For the contribution to critical thinking mythbusters received an honorary doctorate from the University of Twente in the Netherlands

John de Croon and Ype Wijnia are partner at AssetResolutions BV, a company they co-founded. Periodically they give their vision on an aspect of asset management in a column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|