Separate risks and opportunities

3 February 2012 • John de Croon

risk management

Many companies are enthusiastic about asset management and are full of energy to get started. A company often has defined a risk matrix (whether or not fitted with traps) and risks are identified and analysed further. This is a beautiful process and we are pleased that companies deal with it. Yet in the many years that we are working in the asset management area the following question arises frequently:

Do I have to treat opportunities and risks in the same way, or should I better separate them?

It's a fair question. The question arises from the SWOT analysis[1], where people find it difficult to separate opportunities and threats. There is also a risk of missing opportunities. Another difference is that you can grab opportunities and risks overcome to you, but there are also risks in which conditions are created so that an undesirable event can occur.

The question is relevant because it is not clear for people whether working with risks and opportunities leads to the same solutions and decisions. If it leads to the same solutions and decisions, then opportunities and risks can easily be combined. Fortunately, scientific research is done by Tversky and Kahneman[2], so this provides specific evidence. And why would we invent something ourselves if we can apply the shoulders of giants? So therefore a brief summary of the useful research is given. The research focuses on an unusual Asian disease.

Imagine that the government is preparing on the expansion of this unusual Asian disease. It is estimated that 600 people are expected to die. A choice must be made which treatment for this disease must be developed. There are two possible choices, see the figure below.

Two programs are possible. In the standard program A there is 100% certainty that 200 people survive. With the innovative program there is 1/3rd probability that 600 people survive and 2/3rd probability that nobody survives.

The question is which option you prefer. In the study by Tversky and Kahneman the majority of respondents chose risk averse for program A.

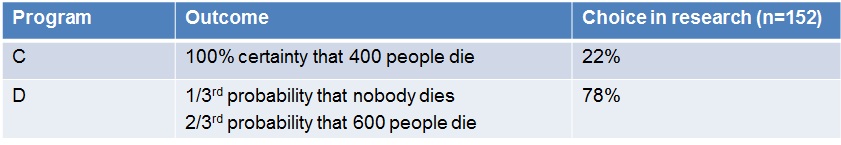

Now a different formulation is applied, see below.

In the standard program C it is 100% certain that 400 people will die. With the innovative program there is 1/3rd probability that nobody dies and 2/3rd probability that 600 people die.

The observant reader has already noticed that statistically the programs C and D are identical to A and B. Regarding choice you could therefore expect the same outcome. But is that the case? The table below shows the results show for the programs C and D.

In the other formulation most of the people chose for the risky program D. It is striking that the difference in the results is very large. The way we solve a problem often depends on the ways in which the problem is formulated or framed. Psychologists speak of the 'framing choices’[3].

By experience we know that many decisions about risks in the asset intensive industry are taken by gut feeling. This study shows that this feeling is very dependent on the definition of the question. What can we learn from the research of Tversky and Kahneman?

The conclusion is simple. In your company you can both work with risks and opportunities. But do not mix these up, because it leads to undesirable solutions! (if for political reasons you want a particular outcome, you however can use them both. But you obviously did not hear this from us......)

[1] Strengths, weaknesses, opportunities and threats

[2] The Framing of Decisions and the Psychology of Choice, Amos Tversky en Daniel Kahneman. Science, New Series, Vol. 211, No. 4481, 1981. Kahneman won the Nobel prize in 2002 "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty"

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|