| |

Maintenance in the boardroom?

24 August 2012 • John de Croon

asset management strategie

I recently read an article in which was stated that maintenance should have more importance in the boardroom. I read those kind of claims regularly. However, often these claims are not made specific. Of course maintenance is important and the board probably also believes this is true, but the same is true for business functions such as manufacturing, finance, human resources and sales. So I cannot disagree with the general statement that the board should believe maintenance is important, but I believe it should be made more specific. Should the maintenance manager actually report to the board? In this column, I will elaborate this topic.

A good friend of mine Joost was, in his previous position, the manager of the maintenance department of a biscuit factory. Of these, more than 100 exist in the Netherlands (often family owned), most of which are compared to other asset intensive companies relatively small[1].

Joost reported directly to the managing director, who was also owner of the compa ny. The direct reporting mechanism was possible, since the management team was small. The advantage was that in this case Joost could directly convince the managing director that it would be useful to carry out more preventive maintenance (so less downtime thus higher output). In order to achieve this, it is would be necessary that production staff should receive specific training, so they can prevent malfunctions and immediately solve simple issues (first line maintenance). It may therefore be useful that a maintenance manager has direct influence on senior management. But what about this in larger companies? ny. The direct reporting mechanism was possible, since the management team was small. The advantage was that in this case Joost could directly convince the managing director that it would be useful to carry out more preventive maintenance (so less downtime thus higher output). In order to achieve this, it is would be necessary that production staff should receive specific training, so they can prevent malfunctions and immediately solve simple issues (first line maintenance). It may therefore be useful that a maintenance manager has direct influence on senior management. But what about this in larger companies?

Due to the maximum span of control, at companies with a size of about one hundred employees or more, the maintenance manager does not directly report to the board for practical reasons. Usually the production or the plant manager does so. However, even in these cases the director will answer the question 'is maintenance important' with 'Yes'. The importance is thus recognized. Are we then finished? No, of course not.

At one of our clients, a large energy generating company, plant managers report to the managing director. The maintenance manager reports to the relevant plant manager. Every quarter the director and the plant managers evaluate the availability of the plants and the costs which are required to achieve this through a formalised process. For the availability and costs specific targets are agreed. When for example too many failures arise, then the plant manager gets the order to ensure that the targets are met anyway. The managing director does not interfere with the content. The goals include the ´what´. The plant manager then asks the maintenance manager to translate the 'what' into a 'how'. This can mean that the maintenance schedules are reviewed and adjusted, because the desired effect is not achieved.

Here a couple things are in place:

- The roles Asset Owner, Asset Manager and Service Provider are in place[2]

- A unified framework is agreed which contains business values and KPIs as well as a risk matrix. This sometimes is called a business value framework

- There is a quarterly plan - do - check - act cycle, which is continuously improved.

This example makes clear that the board sees the importance of maintenance, without the maintenance manager himself having direct contact with the managing director.

Yet we see these things could be improved in other companies. This has a number of reasons. First, the roles are not always defined clearly. The managing director (e.g. the Asset Owner) should not take the position of the maintenance manager (e.g. Service Provider) and determine that the preventive maintenance frequency should be increased. Indeed, this can be a very expensive measure, while other (cheaper) measures may have the same effect (e.g. first line maintenance). Sometimes it also lacks a unified business value framework. Also there are often several risk matrices, which aim at different goals. The maintenance manager has created one for maintenance, finance has one to validate whether insurances are required and there is for example one available related to work safety. These matrices are not consistent with each other. So it can happen that different employees assess the same risk in risk matrix 1 as being acceptable, while in risk matrix 2 it is classified as being not acceptable. In combination with the roles which are not clear, the maintenance manager could himself determine the limits for acceptance of risk. Thus, the maintenance manager takes the responsibility of the managing director. Therefore a risk matrix is required at board level[3], implemented with clear roles and a periodic evaluation of the performance of the KPIs and the risks which the company faces. That is (much) more important than that the maintenance manager himself reports directly to the managing director.

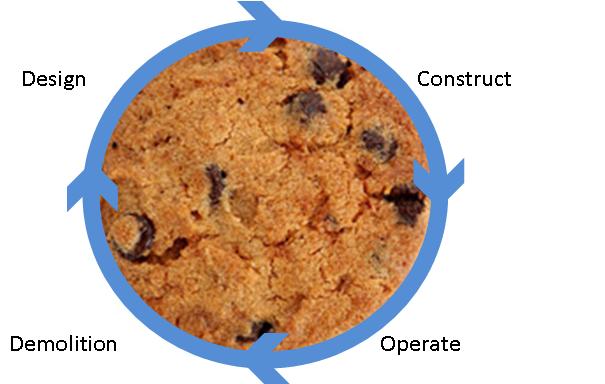

That brings me back to the title ‘Maintenance in the boardroom?’ It ends with a question mark, and with a reason. The asset management concept (and PAS55) has been created to provide optimal value with the assets. Rationale included the prevention of functional silos, the holistic view of problems and breaking walls between departments organised according to the life cycle of assets.

So I would like to change the title to ‘Asset management in the boardroom!’ Then maintenance is automatically represented. This means that the asset management roles must be clearly implemented (the board is the Asset Owner), a uniform business value framework must be established (for which the board is responsible) and a periodic evaluation must be executed on the asset management performance and the risk profile. Discussing the performance and risk profile can be done with the maintenance manager, but it does not necessarily have to be the case. It can also be a plant manager. With the board the objectives and (organisational) impossibilities to achieve them should be discussed. But you should not discuss the content of asset management with the board…

[1] Number of staff between tens one hundred and about a couple of million Euros invested capital.

[3] It can possible to have matrices derived from this one, but these should be coherent and thus lead to the same classification of a risk

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|