| |

Loss of turnover

27 March 2015 • Ype Wijnia

asset management strategie, risk management, policy development

This week a press release of Detailhandel Nederland[1] (Retail Netherlands) appeared with complaints about the operation of iDeal, which was published in many media. Contrary to what you might expect, the name iDeal is not the new payment function on Apple's iPhone, but a way to settle purchases on the internet. In the Netherlands, this is the most common method of internet payment. According to the press 190 million transactions are dealt with via iDeal annually, which itself incidentally speaks about 180 million transactions. Other sources have added that this is 53% percent of the total number of transactions. In total about 14 billion euros will be converted with purchases over the internet. If we assume that there is no correlation between the size of the amount and preference for iDeal or any other system, about 7 billion revenue will be dealt with via iDeal per annum. If that is not reliable then the retailers have a point, you might say. Especially if that is during crucial moments just before Sinterklaas (our equivalent to Santa Claus at beginning of December) or Christmas. The press release claims that iDeal is not available during 1,5 days per year, and compares this with the unavailability of electricity of 28 minutes per year in the Netherlands. Thus they create iDeal into a utility, and the message is therefore that the second chamber should impose a 100% availability standard to the common banks.

Large numbers always ask for juggling. In one of the news messages this also happened quite a lot. 14 billion per year translates into 40 million per day, which in itself again translates into 27,000 euro per minute. That sounds like a lot. On the other hand, we can also juggle with numbers. 14 billion is about 1000 euros per Dutch. Given a gross domestic product of about 40,000 euros per Dutchman, this does not sound like a huge amount. The vast majority of our spending we do apparently still in a different way. And that's true though. The number of PIN payments (electronically but in the physical store) in 2014 amounted to almost 3 billion, more than 15 times the iDeal transactions. Per month is paid as often with PIN than in a year with iDeal. While we're talking about the number of transactions, an average Dutchman according to the data apparently conducts about 10 iDeal tranactions per year, so about one per month. If the number of days of unavailability indeed is 1,5 per year, this means that approximately 1 in 20 Dutch has seen a failed iDeal transaction in 2014. That does not sound like very unreliable. The number of times you forget your wallet in a normal shop is so to speak larger.

Anyway, what is it really about? Internet retailers claim they lose sales due to iDeal failures. Assuming that this is true, how much would it be? The data rates of 1,5 days per year imply an unavailability of 0,5%. If sales are evenly distributed over time, it would mean a loss of revenue of 28 million per year. But suppose the faults occur during peak times, such as the iDeal system becomes overloaded. This amount could be much higher, perhaps a factor of 10.

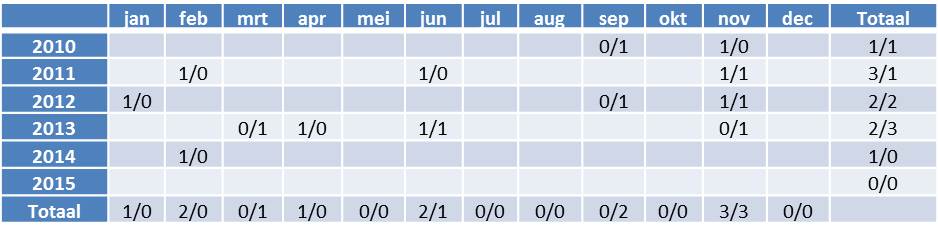

iDeal does not point very convincing on this in their figures. The table below shows the months in the period 2010-2015 with per month shown whether iDeal’s own availability standards were violated. It is striking that November is reflected in almost all years. Since then many possible purchases for Sinterklaas and Christmas are done, there seems to be some ground for the claim of the shopkeepers. Only in 2014 there standard was not violated in November. In fact, there are far fewer problems in 2014 than in previous years. It seems then, that if there was a problem this has been largely solved.

Table 1: The months in which the iDeal service requirements were not met (source data iDeal website). The figure before the slash during prime time (7:00 to 01:00), following the slash in non-prime time (1:00 a.m. to 7:00)

The best estimate for the revenue loss is therefore the assumption of proportionality, making the amount to 28 million. However this is only the turnover, not profit. Margins of course are a well-kept secret, but because the internet invites price comparisons that will be limited. If the marginal profit is 20%, then the non-availability will cost retailers 5,6 million euros annually. Can you make a 100% reliable system with this? That seems not to be the case. The cost for iDeal will be around 0,4 euros per transaction, depending on the exact amount. For 180 million transactions shopkeepers have to pay something like 72 million euros per year. To achieve the reliability of the electricity grid (but that is still not 100%, only 99,995%) a full redundancy is required, which roughly equates to a doubling of the system. This is indeed the way reliability of the energy supply is achieved. That would amount to 72 million per year in additional costs. Much more than the reduced profit for the retailers, under the assumptions we have made. Economically, it would be utterly absurd to spend 72 million in order to earn 5,6 million. If the shopkeepers think the banks are going to pay these costs that can make sense, but eventually the costs will end up at the retailers.

It is even questionable whether the unavailability does lead to loss of sales. Suppose an iDeal transaction does not work, what does a customer do? This person may try another website, but if iDeal is unavailable one cannot purchase somewhere else. The customer could also go to a physical store. Revenue then admittedly runs through another channel, but it is still there. Only if the customer decides not to purchase if the transaction fails, there is actually lost sales. That seems unlikely. Online purchases are excellent for price comparison and thus are an informed choice. If the transaction fails, the customer will generally probably try again later. Revenue is postponed then, but does not disappear.

That of course does not mean that an individual retailer cannot suffer from an iDeal failure. If you rely on the internet because you have no physical store and there is interference in the busiest month of the year, this is extremely annoying. But in the chain of iDeal, the source of that failure can be just as well in your own website or it can be in the banking system. The observation that the transaction does not work via iDeal does not mean that iDeal fails itself. Moreover, even with a malfunction, a part of the turnover will be created in a different way. Only the real impulse purchases will not be repeated. But perhaps that is a blessing, because there was apparently no need.

Ype Wijnia is partner at AssetResolutions BV, a company he co-founded with John de Croon. In turn, they give their vision on an aspect of asset management in a biweekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

[1] See this link of Detailhandel Nederland: "Detailhandel: iDEAL moet binnen twee jaar storingsvrij zijn" (retailers: iDeal should be without failures within two years)

<< back to overview

|