Life cycle costing is required for asset management

7 September 2012 • John de Croon

policy development, planning

Terminology. It is common and often there are no uniform definitions. Also, the relationship between certain terms is not clear. Thus with some regularity we get the question whether and how life cycle costing fit in asset management. Here already a brief answer: it fits perfectly in the asset management process. Indeed, life cycle costing is a methodology that should be an integral part of proper asset management. In a previous column[1]we have described the PAS55 compliant asset management process. It can be seen here

B.S. Blanchard developed the life cycle costing concept in the early 60s[2]. For the U.S. Department of Defense he found out that the operation, maintenance and demolition costs were underestimated in the investment decision. B.S. Blanchard developed the life cycle costing concept in the early 60s[2]. For the U.S. Department of Defense he found out that the operation, maintenance and demolition costs were underestimated in the investment decision.

Life cycle costing is the method which makes financial considerations throughout the life cycle of equipment possible. The idea is that all costs over the life cycle are taken into consideration when making investment decisions. Think of the initial investment, operations and maintenance and demolition costs[3]. According to Blanchard, a number of steps must be taken with the following content:

- Determine the system requirements, expected technical lifetime and preparation of evaluation criteria

- Create a distribution of the costs for example over the life time. Also determine the way the costs are controlled

- Determine which expenditures are made during the life time

- Discount the expenditures (‘charge back’) to the present day with an appropriate discount rate.

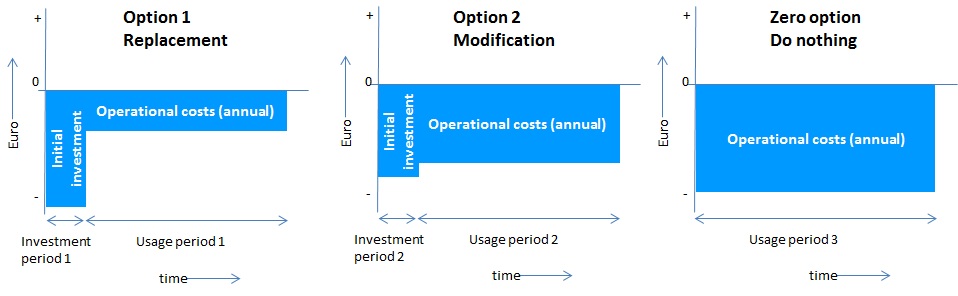

Suppose that in the ´Risk management´ process (see picture above) an unacceptable risk is identified, such as the non-availability become too high. In the ´Policy development´ process options for risk reduction are compared and the most attractive option is selected. In the process 'Planning' is determined when the option will be executed (taken a budget constraint into account if applicable). Suppose that option 1 is a replacement, option 2 a modification and option 3 is the 'zero option': accepting the risk and do nothing. With options 1 and 2, the risk is sufficiently reduced so it is acceptable again. The evaluation criteria are that the non-acceptable risks per business value become acceptable.

For each option the costs over the lifetime are determined. To make it not too complex, we keep it limited to the single (initial) investment and constant annual costs. In practice, these costs can vary both in amount and also in terms of timing.

In the figure, a simple example can be seen of the method for the two mitigation measures and the zero option. Suppose that for option 1 the initial investment of the replacement is higher than in the modification of the second option. Since option 1 contains state of the art technology, the annual cost of the second option are higher in this example.

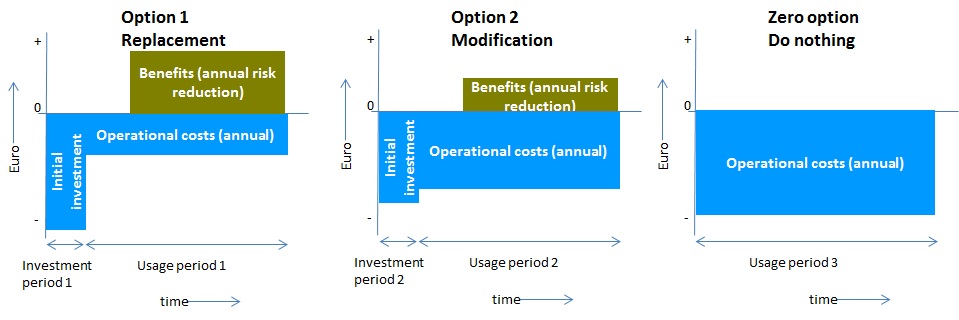

The annual operating costs (e.g. maintenance, operation and usage) of option 1 in this example are therefore lower than for option 2. Now we add benefits to the figure. In asset management it is the annual risk reduction for the different business values. In this case the higher availability translates into more production and thus more money. Suppose the expected annual outage costs for option 1 are lower than for option 2, this then results in the following figure.

We then calculate the net present value of the costs. It compares the present value of money today to the present value of money in future, taking inflation and returns into account[4]. The advantage is that a net value can be compared, in which the various moments the costs are incurred are settled. Options throughout the life cycle can thus be compared, as well as options of different lifetimes.

In summary: the ideas of life cycle costing fits perfectly in asset management. It even is an essential integral part of asset management. After all there is a reason that PAS55 takes the entire life cycle into consideration.

[3] See e.g. wikipedia

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|