| |

Kinds of asset management: explanation of the differences

27 July 2012 • Ype Wijnia and John de Croon

asset management strategie, risk management, policy development, planning, program management, manage changes

In the previous column, part 1 of a series of 4, we have shown that there are at least three different kinds of asset management. The financial asset manager thinks primarily in terms of purchase and sale of assets, the factory asset manager especially in maintenance and operation of assets and infrastructure asset manager especially in terms of investment planning. Yet they find themselves all asset manager and recognize themselves in the definition of asset management (borrowed from PAS 55). In this column, we therefore examine the reasons why these differences exist.

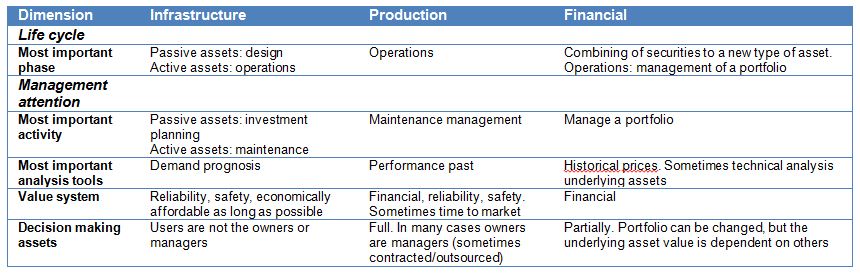

For this we use some insights from the scientific world. The first is from Stacey[1], who established a relationship between the length of the planning period and the certainty with which could be scheduled. In short, the further in time horizon, the more uncertain the planning. The driving forces behind this uncertainty are generally matters as the development of new products, changes in market demand and developments in production technology. For some assets, developments go faster than for others. Komonen[2] has translated this insight into asset management. Yet that does not explain everything. Infrastructure asset management has such a stable technology in a stable environment, suggesting that much attention is given to maintenance, but that is not the case. Apparently there is something in the characteristics of the asset, which puts focus on certain stages of the life cycle. In a EURENSEAM meeting in Seville an integral framework is set up. From the asset management platform of the Delft University of Technology some interviews are conducted with the framework, with the underlying question whether there was a relationship between the asset characteristics and environment on the one hand and the focus on the life cycle phase and the kind of asset management on the other. This is shown in the tables below.

Table 1: The driving forces

Table 2: The core of asset management

If you take a look at the characteristics then the observations on what the core of asset management is, is easy to explain. If most assets are passive (as in infrastructures), it is logical that those asset managers pay little attention to the operation of the asset. That is not necessary. The same goes for the maintenance. An asset which barely wears does not have to be maintained. An infrastructure asset manager can be relatively indifferent about failures, because he is not directly affected himself. This since he is not the user.

A similar logic is applicable for the factory asset manager. If the life cycle of the plant is longer than the life cycle of the products you make, you run a significant chance that in the end you remain with worthless assets which still are at a technically good state. So it is better to use some less good assets which you have to repair a few times. Then the factory life cycle has ended at the end of the product life cycle as well. Hence the focus is on maintenance and operation.

The financial asset manager also has to respond as good as possible to the environment. If the value of the assets is determined by the emotion in the market then the asset manager needs to take a look. Although the shape of the price chart says nothing about the future expectations, the fact that many people still look at it makes a self-fulfilling prophecy possible[3].

We immediately see a step to the similarities between the various kinds of asset management: they all try to deal as much as possible with the risks that threaten the value of the assets. We will describe other similarities in the next column. Until that time, we think of our own maintenance passively in a chair somewhere where the weather is nice. Possibly we consider whether we have to buy a golden asset with white collar.

[1]Stacey, R.D. (1990), Dynamic Strategic Management for the 1990s – balancing opportunism and business planning, Kogan Page Ltd, Londen.

[2]Komonen, K., et al. (2010), Investments, capacity and maintenance: ways to safely increase capital turnover. in Euromaintenance 2010. Verona, Italy.

[3]Related to the previous column, we indeed did not understand it well.

John de Croon and Ype Wijnia are partner at AssetResolutions BV, a company they co-founded. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|