Determine your vision outside-in or inside-out?

20 January 2012 • John de Croon

asset management strategie

Stakeholders are groups that affect or are affected by your organization. You can think of customers, employees, management, suppliers and regulators, but also 'the environment of the company'. They determine the context in which a company operates. Some stakeholders are obviously more important than others and the importance of these stakeholders may change over time. In short: you should (continue to) take the stakeholders into account.

In PAS55 is mentioned that an organization should identify the stakeholders and that it should be considered how the demands of these stakeholders should be handled. The Dutch asset management standard NTA8120 goes even further and states that the business values need to be established by the board in consultation with stakeholders. But what is consultation? How far should one go? Do you even want to consult your stakeholders?

Some asset intensive companies consider the needs and demands of stakeholders as a fact which must always be met. In this view, the stakeholders have an interest to which the asset intensive company must comply. The asset intensive company therefore has to adopt to her environment. This is called ‘outside-in thinking’.

The ‘inside-out’ approach is the opposite. A company develops a specific mission and the wants to influence the environment in such a way that the environment adopts to the company. For an asset intensive company it is important to think about the above. A black and white choice is not necessary, but you should realise that the environment can affect you more than you might have thought.

Outside-in or inside-out thinking: do you let yourself influence by your environment, or do you influence your environment yourself?

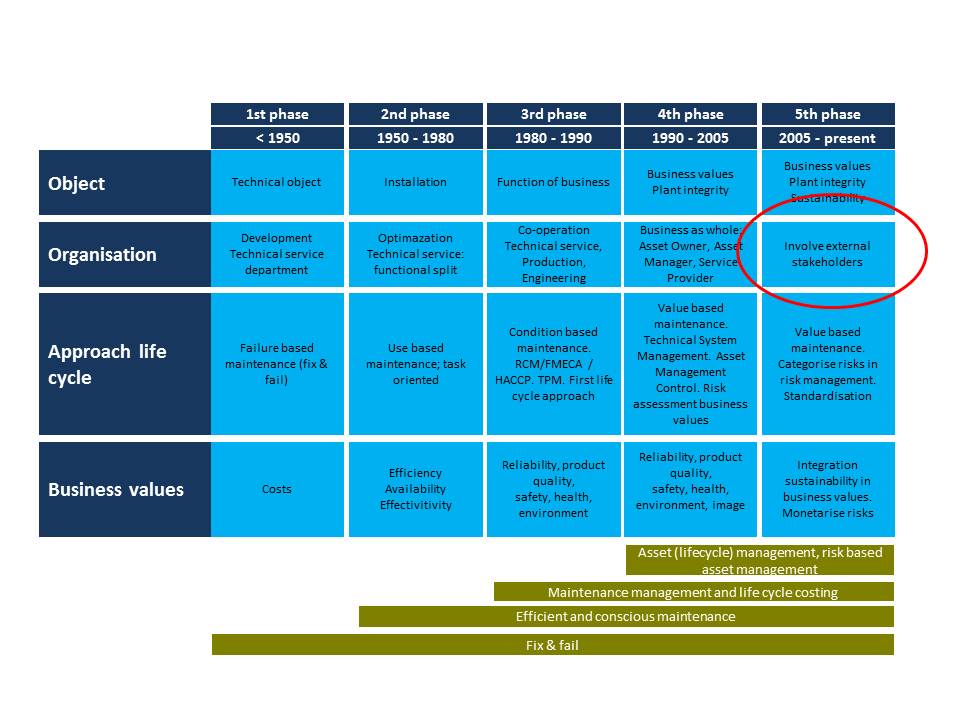

In the world of asset management, we see that some companies currently involve their stakeholders more than previously in their policies. We call it the 5th phase in asset management, as shown in the accompanying maturity model.

The question is what you should discuss with your stakeholders. The desired risk exposure can be a starting point: which risks are acceptable for the relative stakeholder and which are not. When a regulator wants you to decrease the cost, does the regulator then also agree that the performance is lower or that the risk increases? If people in the immediate vicinity of your assets want a lower risk level, are they then also directly or indirectly willing to pay for it? It therefore deals with the (subjective) balance between the financial and operational performance and the risks which an asset intensive company faces.

Maturity model in asset management

Taking the stakeholders into account is an important part of asset management. Instead of having agreement on the design principles of solutions, agreement should be made on which risks are acceptable and which are not. This also implies that the asset manager must take responsibility for unexpected events.

Since the performance of a company can fluctuate over time, an active stakeholder input is needed to find and keep the balance. Involving stakeholders can have benefits, but there are also disadvantages.

The risk is that stakeholders get too much influence. This may result in an unworkable situation where stakeholders want no cost, 100% performance and no risk. There is also the danger that stakeholders put them in the asset manager’s position and enforce decisions, with which no optimal value is achieved. When stakeholders get control over your organization, you sooner or later run into problems.

You probably read it between the lines already. Our tip: take your stakeholders into account, involve key stakeholders actively, but do not go too far in giving influence. Whether you apply the inside-out or outside-in philosophy is not really interesting. Much more interesting is it that you know the needs and demands of your environment and that you also at least discuss your own requirements and wishes. This provides a great advantage: the ‘moving space’ is clear and you can find each other at least when there is really big trouble!

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|