Depreciation how it should not be done

13 September 2013 • Ype Wijnia and John de Croon

policy development, planning

Now that the summer weather is behind us and the meteorological autumn immediately showed its best side (what a water came from clouds) it is time to go back to on our work: writing columns. Talking about columns, we are often stalked by people who want to know how the depreciation methodologies relate to asset management. Our simple answer is always "Not!" but that is usually not accepted and the question remains to be asked. The result is that we – in order to be able to continue our job – ask for a restraining order, but that almost only ends up in whining. That's why we want to make this clear for once and for all by means of a column. Because it is a complicated subject, one column is not sufficient. This week we start with the subject and in the next column we will ‘write it off’.

Let's start with the question what depreciation is. Briefly, depreciation divides the purchase cost of an asset over the lifecycle of the asset for the profit and loss account. Imagine a cookie making machine is purchased with an intended useful life of 10 years. If that investment is fully charged to the profit, then in the first year there is a substantial loss and in the remaining nine years a large profit. Companies do not like to book losses[1] due to shareholders and banks and so on, so there are rules agreed on how can these costs can be spread. These are the depreciation methods. Examples include linear, linear with a certain residual value, discount (to linear or by means of a fixed percentage of the book value), a fixed reduction amount, annuity and based on usage/performance (see, e.g. Wikipedia or almost any economics book) with per asset different depreciation periods. So the purpose of depreciation is to stabilize the profits of the company. But as a familiar expression in the financial world is:

Cash is a fact, profit is an opinion

Because asset management is about facts and not about opinions (we hope) the relationship between depreciation and asset management is zero, nothing, nada, at least from accounting to asset management. Conversely, asset management decisions have to be taken into account at accounting. We will now illustrate this with two examples of how it should not be, next time let's see how it should be.

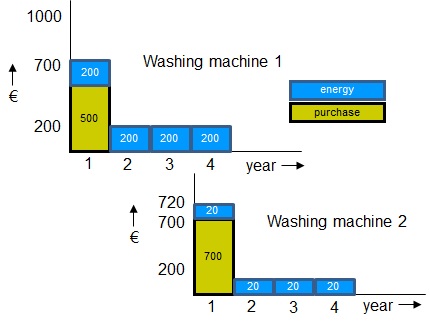

The first example is about an asset that may not be replaced because it has not yet been written off yet. Suppose for four years ago you have bought a new washing machine for 500 euros, with the idea that it  should last 10 years. The washer washes fine and that will cost you 200 euros in energy a year. After four years, that washing machine has cost 1300 euros in purchase and usage. Today, a new model arrives on the market that can be bought for 700 euros, but it costs a tenth in energy for the same amount of wash cycles. Is it wise to make this investment, or should you just wait until the old machine is worn out? If you set the options side by side you can see that continuing with the current machine costs 6 times 200 euro = 1200 euros, while the new machine will cost initially 700 euros plus 6 times 20 euros makes 820 euros for 6 years. That is almost 30% less. This comparison is not entirely fair because the new machine will probably last a while after 6 years, while the old one may need to be replaced. The real benefit is likely to be even slightly larger. So for expenditure in the future it makes no difference whether the investment has already been written off as expenses in the past are indeed already done[2], you cannot change anything about it. should last 10 years. The washer washes fine and that will cost you 200 euros in energy a year. After four years, that washing machine has cost 1300 euros in purchase and usage. Today, a new model arrives on the market that can be bought for 700 euros, but it costs a tenth in energy for the same amount of wash cycles. Is it wise to make this investment, or should you just wait until the old machine is worn out? If you set the options side by side you can see that continuing with the current machine costs 6 times 200 euro = 1200 euros, while the new machine will cost initially 700 euros plus 6 times 20 euros makes 820 euros for 6 years. That is almost 30% less. This comparison is not entirely fair because the new machine will probably last a while after 6 years, while the old one may need to be replaced. The real benefit is likely to be even slightly larger. So for expenditure in the future it makes no difference whether the investment has already been written off as expenses in the past are indeed already done[2], you cannot change anything about it.

Moreover, even when it comes to the profit and loss account is it a wise investment. The depreciation of the new machine would be 70 euros per year, plus an energy consumption of 20 euros plus 50 euros for the amortization of the old machine makes a total of 140 euro. That is well below the energy costs of 200 euros for the old model. Even if the new machine would be depreciated over the six remaining years it is an attractive investment, although the difference is small.

For the second example we look at what the right decision is at the end of life. Suppose indeed a new machine is purchased and this new machine is depreciated after 10 years. Should that asset be replaced? As asset manager you must then ask the question what happens if you do not replace the asset. For example are there indications that the reliability decreases or that the operating costs increase? Also you need to wonder whether there are other alternatives than replacing the entire asset. Can you replace the worn parts such as bearings separately? Or is there perhaps better technology on the market? In the previous example we showed that you should always ask that question, but with rising costs this may be more attractive at the end of life.

Such questions are not reflected in the depreciation method. The period is chosen such that there is reasonable assurance that an asset is depreciated before it is taken out of service, otherwise (accounting) divestments are required. But a certain margin is built in here. Reaching the end of the depreciation period says nothing about any technical remaining life. In all honesty this also says nothing about the economic remaining life, which also depends on the operating costs compared to competing alternatives.

So it is not the case we write off the depreciation method for assets, but the method is more suitable for accountants than for asset managers. Next time we come back to the way you can bring cohesion.

[1] For the record, even the IRS does not accept if investments come at once at the expense of profits, since it implies postponing tax payments

[2] The so called sunk cost

John de Croon and Ype Wijnia are partner at AssetResolutions BV, a company they co-founded. Periodically they give their vision on an aspect of asset management in a column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|