When does asset management start?

10 April 2015 • John de Croon

asset management strategie, risk management, policy development

|

916 persons

like this column |

Every now and then the discussion comes up again: what is the scope of asset management? It is clear that in asset management a lifecycle is involved, but to what extend? Is it only in asset management to propose maintenance work on existing assets, or also expanding modifications and new construction? Or are even acquisitions or new business development in scope? It is then obvious to read the standards of the ISO55000 series to extract the answer. The first clue to the ISO55000 standard (section 2.4.3) is the asset management context.

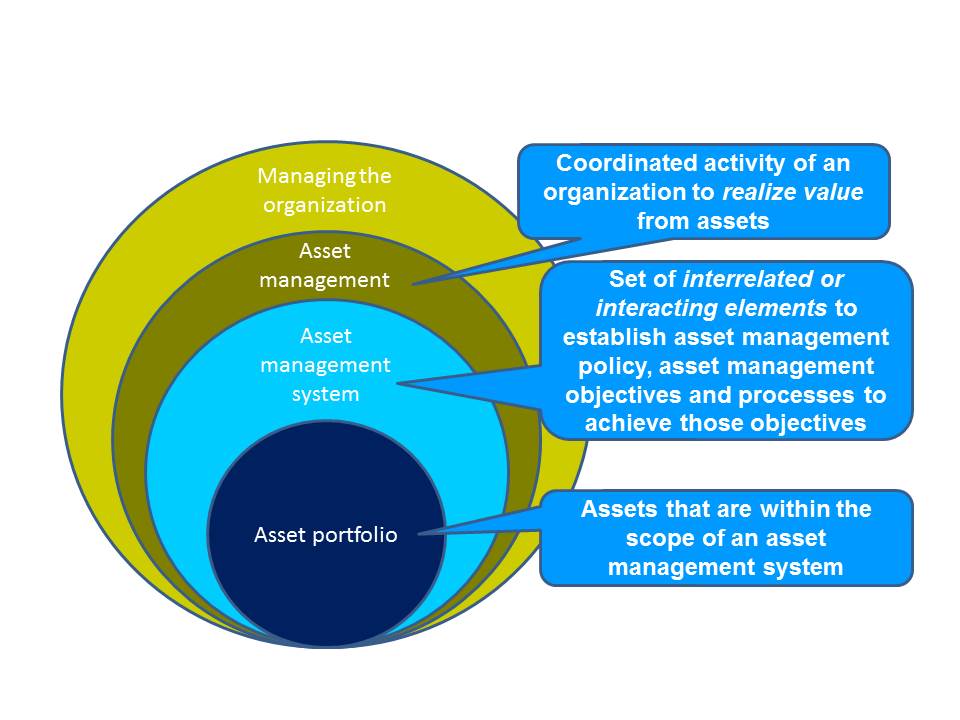

It can be seen that asset management is within the management of the organization. Within asset management, we have the system and within this a set of assets. According to the figure it deals with assets that are within the scope of the asset management system.

According to the explanation (ISO55002) the boundaries and scope of the asset management system must be documented in a statement on the scope, which may be included in the strategic asset management plan. So this leaves room. However the question is not yet answered.

Furthermore, in the series it can be read that assets can be critical in terms of safety, the environment or performance. When business values are ​​at risk, it is straight forward that the asset manager plans maintenance action for the existing assets. It is not mentioned explicitly, but you could also infer that when the capacity of current assets of a company is not sufficient, it is necessary for the performance of the company to build new assets. Also can be read in paragraph 6.1 of ISO55001 that measures should be defined to address the risks and opportunities associated with managing the assets. And as is the same standard is described the asset management objectives must be derived from the organization's objectives, this implies that the decision to build a new plant (thus an opportunity) belongs to the asset management function. Is that right?

The point is that it is not explicitly stated. Does the asset portfolio regard existing assets, or new? In several columns we have already discussed the roles in asset management[1]. We have previously described that the asset manager is responsible for investment planning and asset owner arranges the financing. In short, new assets belong within the context. Simple right?

For any infrastructure manager this is valid when the asset manager has arranged a performance agreement with the asset owner (for example, everyone connected to infrastructure). In anticipation of new residential areas (although, where are these in the current crisis?) that are projected and recorded in the zoning plan, the relevant asset managers provide a new drinking water supply, drainage of rainwater and wastewater, energy, telecom and so on for those areas[2]. When that infrastructure fits within the budget for the approved portfolio by the asset owner, one can start work.

Now think about a manufacturer of food products, such as soup. If within a particular market (eg Europe), for example the demand of delivering soup can no longer be met, the asset manager can analyze if the OEE (Overall Equipment Effectiveness[3]) of the existing plant(s) can be improved by example to increase the speed of the production line, to establish a fully continuous service and reduce losses. This type of work is associated with the role of asset manager. For that asset manager taking the decision to build a soup factory might already be tricky: the asset manager must have insight in the longer term market demand and has to know if investing in a new soup factory fits the business strategy. That asset manager of the soup factory will not just make a proposal to build a new soup factory or take over an existing one in a market where the company is not already present (eg China). Also then such a proposal would be made only when it suits very clear to the organization's objectives and the (assets for the) new market are defined within the portfolio.

When a city council wants a new theater, an asset manager can have an opinion about it. The asset manager can then analyze whether the question behind the solution cannot be solved with current assets and the asset manager may then propose a modification for expansion. Whether an asset manager itself comes with a proposal for a new theater, is highly dependent on whether an agreement is made with the asset owner on one asset(group) within the portfolio (the asset manager will then propose maintenance or modifications) or a performance agreement across the portfolio (the asset manager can suggest new building itself).

The conclusion is that making decisions about opportunities suits the task of the asset manager, provided that clear agreements about the performance of the portfolio are met with the asset owner. When appointments are made on a single asset(group) of the portfolio, then it ends about in proposing modifications of expansions.

If the boundaries are not made clear, it is recommended that the asset manager is only concerned with the existing assets. Then let the asset owner or stakeholders outside the organization can act as entrepreneurs and determine the need for a new asset or acquisition.

[1] http://www.assetresolutions.nl/en/column/sense-and-nonsense-of-splitting-asset-management-roles

[2] Hint: think of scalability. Prevent the creation of an entire infrastructure with large uncertainty involved

[3] http://en.wikipedia.org/wiki/Overall_equipment_effectiveness

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|