| |

Paradox of choice

23 March 2012 • Ype Wijnia

policy development, planning

In a previous column I stated that decision making is a profession. The decision analyst collects data and structures them in such a way that a preference for one of the options becomes apparent. That may sound complicated, but in practice it is not that hard. It is just about quantifying costs and benefits, translating them into a single scale and rank them on that scale.

There are many options to achieve this. A very direct method is just relying on your gut feeling. If you are in a supermarket to get food you do not do an extended analysis of what you could eat, what that would cost and what benefits it would bring, you just buy the food you have an appetite for. Or what is on sale. Yet, most people will be out of their comfort zone to make decisions this way if the cost of the purchase is bigger. If you are shopping for a new car, you most likely will consider a number of brands or types and puzzle a while to get the pros and cons of the alternatives aligned. Only then a founded decision is made. But that is still difficult: how to compare the pro of one car that can be painted in precisely the right color with the pro of another car that the seats are excellent? And there is always the risk that things are listed as a benefit which later turn out to be not needed. Some things may have an option value: even if you are sitting most of the time alone in the vehicle it can be handy if you can transport 7 people. However, the salespeople will try to frame every unique property of the product as a benefit and as they have an interest in doing so a bit of suspicion could do no harm? Is it really a benefit if the paint blisters quickly so that you can paint your car every year in a new color? Before you know it you go shopping for a car and come home with a boat, which may be useful if the levees fail (for the foreigners reading this: about 60% of the Netherlands is prone to flooding).

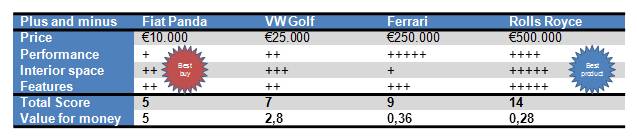

A method to avoid this pitfall is to think in advance about the requirements the alternative has to comply to, or about the criteria on which the alternatives will be judged. Requirements are for example that there should be 4 seats, ample of interior space, load bearing capability and a price below a certain level. If you then add that it should have four wheels you will never end up with a boat. Next, the additional criteria can be listed, like the features, the mileage it gets, maintenance costs, comfort, handling, performance and many more. Alternatives can be scored on those items, for example with plus and minus points, and the option with the net highest score (a plus and minus point cancel each other out) than is the best choice to make. Often the price is used as a separate criterion, so that a distinction can be made between the best product (highest score) and the best buy (most plusses per euro). According to the table below which compares four cars, the Rolls Royce is the best product but the Fiat Panda is the best buy.

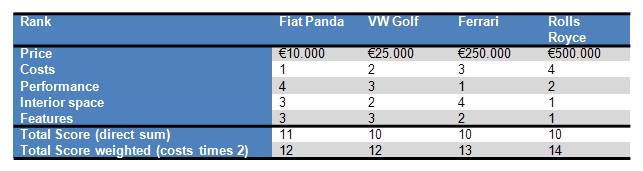

Unfortunately this method is not without flaws. Doing math with plus and minus signs presumes the plus and minus to have equal value, and that hardly ever is the case. A slightly more advanced method translates the score on a criterion into a number. That can be the rank of the alternative on that criterion. An advantage of numbers is that they allow for calculation and that weight factors can be added.

Yet, a disadvantage of using the rank is that it does not take the huge differences into account that can exist between scores. For the price of 1 ferrari, 10 golfs could be bought, whereas the difference in points is only 1. Another disadvantage is that the score may change if an alternative is added and that is strange. The score then apparently is not attached to the car but to the comparison, and the goal is to judge cars on their value. The first problem can be countered by not using the rank as such, but the position it takes between the extremes and using the difference between the extremes as a weight factor. But the second problem persists, the judgment only has meaning in precisely this comparison.

The only way to avoid that is using an absolute scale. This can be grades (like 1 to 10), with a weight factor per criterion or cluster of criterions. But such a system has a limited range it can span and will have difficulty to deal with a difference of a factor 50 like the prices in the example. It is more effective to use a measured value on all criteria and translate those to a single scale of points, or even into a monetary equivalent. The advantage of monetizing is that the comparison can be transformed into an investment decision. Does the car provide more value than it costs? A problem can be that none of the alternatives has a positive value. That is why the current situation should be part of the comparison. What is the score if you do not make a choice but continue the current situation? If that if more negative than one of the alternatives, your situation can be improved even though the alternative may have negative value.

But do you know what is the anomaly? If the alternatives are very far apart you really do not need a decision model. A Fiat Panda and a Ferrari will hardly ever be regarded as alternatives for each other. But if the alternatives are close together the decision model does not really help, as they will score comparably. Differences can be enlarged by means of weight factors, but then a direct choice for an alternative is replaced by an indirect choice for a weight factor. This is the paradox of choice: the closer the alternatives are and the less it matters what you choose, the more difficult and thus more expensive the choice becomes. That does not mean the quest to determine criteria and requirements has no value, but that is not in the choice. If you find it difficult to choose between two alternatives you might as well flip a coin. And if you do not like the outcome you just take the other.

Ype Wijnia is partner at AssetResolutions BV, a company he co-founded with John de Croon. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|