| |

Asset Management: Philosophy or instrument?

23 November 2012 • Ype Wijnia

asset management strategie, risk management, policy development, planning, program management, manage changes

Sometimes, asset management is presented as a totally new way of working. Optimizing maintenance policies, minimizing risk, driving efficiency, managing the asset portfolio, all new and exciting. It almost makes one wonder how we ever survived without asset management. The professional skeptic two answers are possible.

The first potential answer is that we already did it. Mankind has been managing assets for ages: think about Roman roads, irrigation in Mesopotamia, cultivation of plants at the start of agriculture and manufacturing tools even longer before. If we did not somehow manage those assets, we probably would not come as far as we did.

The second potential answer is that asset management is not needed at all. Asset management is just a collection of empty terminology that has been invented to make the life of people doing real work harder.

Both answers presume the way assets are managed right now is good. It is not that there are no options for improving the current practices (good is not perfect) but that improvement is generally an incremental change in the current practice. What is often mentioned for improvement is the area of risks and statistics. If asset management is anything at all, it is a dressing of risk management on top of existing practices: not a new way of working, just a new tool. Given that most assets in the constructed environment have been around for a very long time this perspective has a point.

On the other side are the believers (or perhaps even evangelists). They claim that asset management truly is a new way of working, as it uses doing nothing as its starting point. According to this viewpoint assets can function very well without them continuously getting attention (like maintenance). As attention can has adverse side effects (maintenance induced failures), no action should be undertaken on the asset unless it is reasonably certain that it brings an improvement. Otherwise it is better to stay clear (keep the hands in the pocket and whistle). Such a paradigm shift (from thou shall maintain to thou shall not touch the assets) is not just a topping, it truly is a new approach, a new philosophy.

Being a skeptic asset management envangelist one certainly wants to know which of those visions is true. Unfortunately, both are true at the same time (and thus also untrue at the same time) but in their own reality. From that own reality it is impossible to see the other reality and thus you cannot prove the other view is incorrect. That sounds complicated, and it is. Within the natural sciences a similar problem existed, the question whether light was a particle or a wave. Certain observations could only be explained by assuming light was a wave (e.g. a rainbow) whilst others (photo electric effect) favored the particle. Only with the insight that there was no single indivisible truth but that two conflicting thruths could be real at the same time a major breakthrough was reached early in the 1900s, culminating in for example relativity and quantum mechanics. It may even be more complicated then it seems at first glance[1]. I will try to explain.

The instrumental viewpoint of asset managament puts the actions on the assets central. The basic elements are cleaning, lubing, balancing and aligning. If this is not done properly, the asset will function less because of resistances, wear quicker because of increased friction, speed up fatigue due to continuous vibration or break due to continuous bending. Those are solid physical mechanisms, and no collection of posh terms will ever change that. It is possible to adjust the amount of those basic elements, or use a different interval between services, or make maintenance dependent on the condition of the asset. But to claim that is a new way of working does seem a bit exaggerating.

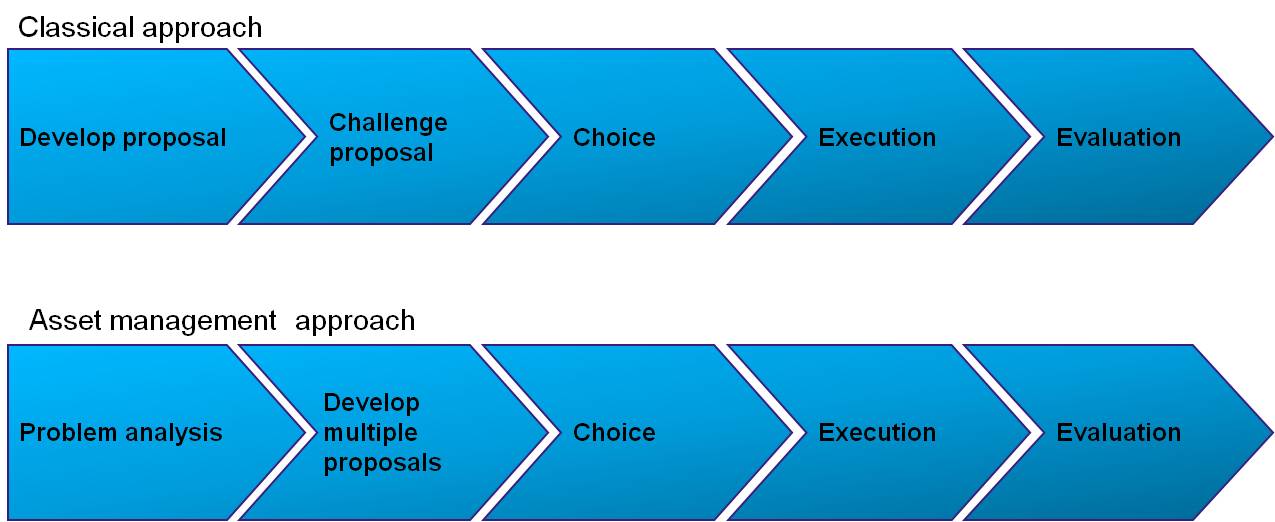

The philosophical viewpoint, on the other hand, puts the people working on the assets central. And in this viewpoint it makes a lot of difference if doing nothing is the reference (and every action a deliberate choice) or that performing actions is some kind of a natural force that has to be dammed by explicit choices to stop doing something. That is expressed in for example the decision making process. In the diagram below, the process on the top is the old-fashioned approach, whereas the bottom one is the asset management approach.

In fact, only the first two steps are reversed[2], but it makes a lot of difference. In the classical approach it is presumed that a source of ideas proposals, that have to be challenged so that only the valuable proposals remain. Choice is a go/no-go per proposal. This means (for the process to be effective) a lot of waste remains, the proposals that are rejected. As nobody wants to produce waste, a whole new dynamic interaction comes to life to get proposals through the decision making process, as if it was a race of arms between designers and decision makers. The implicit assumption in this viewpoint is that proposals are generated for all problems, so that the decision maker does not miss anything, but in practice that proves to be wishful thinking.

In the asset management approach much more attention is given to developing multiple alternative solutions for the relevant problems, in order to facilitate a choice beyond yes or no. If this process is implemented correctly, the first step in this process is identifying all potential problems (i.e. risks) before starting to work on solving those problems. Otherwise all time might be spend on solving the first problem encountered which is not necessarily the most important problem. As identifying a problem generally requires less time than developing a solution and solution development and choice can become an iterative funnel, this approach results is much less waste. The process up to the execution therefore is much more efficient. Some people may start pointing out that decision making is only a fraction of the total costs of a project, but that does not seem correct. Often more than half the time spent on projects is on preparation and not execution.

Even though asset management may, to a large extent, result in similar actions on the assets as the classical approach, the change in working practices is big enough to claim a paradigm shift. Asset management thus is more like a philosophy than like an instrument. Though that philosophy has more to do with management than with assets.

Ype Wijnia is partner at AssetResolutions BV, a company he co-founded with John de Croon. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

[1] In case you do not have quantum mechanics and relativity readily available, it might be a comforting thought that probably nobody truly understands them.

[2] In our first publication we named this Chain Reversal (dutch: “Ketenomkering”, see “Ketenomkering bij Essent Netwerk Noord”, Energie&Techniek 7&8 2003 of Y. C. Wijnia, J. de Croon, and W. te Meerman

<< back to overview

|