Sustainable asset management

23 March 2018 • Ype Wijnia and John de Croon

asset management strategie, risk management

The attentive reader must have noticed that it has been quiet for a while in the field of columns. Our last real column dated from December 24, 2015[1]. You must have lived under the same stone as we did if you did not notice. There are of course all sorts of reasons for this: the bridge was open, a cow broke in[2], the dog had eaten the car keys[3], one of us had to get a PhD[4], the train did not stop at the station[5] and so on. What also played a part was that it was our hundredth column. Then the inspiration is pretty much exhausted. So writing columns was not a sustainable activity for us.

Now that we (100% coincidentally) talk about sustainability: that was also the subject of our last column. We then discussed the memorable Paris climate agreement in which it was agreed to do everything possible to limit global warming to a maximum of 2°C. In fact, this means that the entire world must be about 100% sustainable from 2050 onwards and that there can no longer be any net CO2 emissions. A wonderful goal, and endorsed (then at least) by almost all countries in the world. But whatever every asset manager knows: an objective without a plan to get there is worth nothing. So how does one actually want to achieve this?

A number of camps can be distinguished in the discussion about the limitation of the impact of man on the world. In the first place, there are (still) the deniers: the world does not heat up because it is the coldest beginning of spring since times, when the world is already warming up then this is natural and not caused by human CO2, as the human CO2 already has an influence then it dissolves automatically because plants grow faster, and we are not the problem but the others. This group will therefore not make a plan.

As a second group we see the pessimists. Man has long since passed the capacity of the world and climate change is almost impossible to stop at 2°C warming. New technology is not a solution, we will have to reduce the energy consumption per person 10-100 times to create a chance. In addition, we will have to limit (the increase of) the world's population. But you do not really see plans to really get this done. It is said it is possible without loss of comfort, but based on the footprint per country you would think that you should return to the prosperity level of Bangladesh.

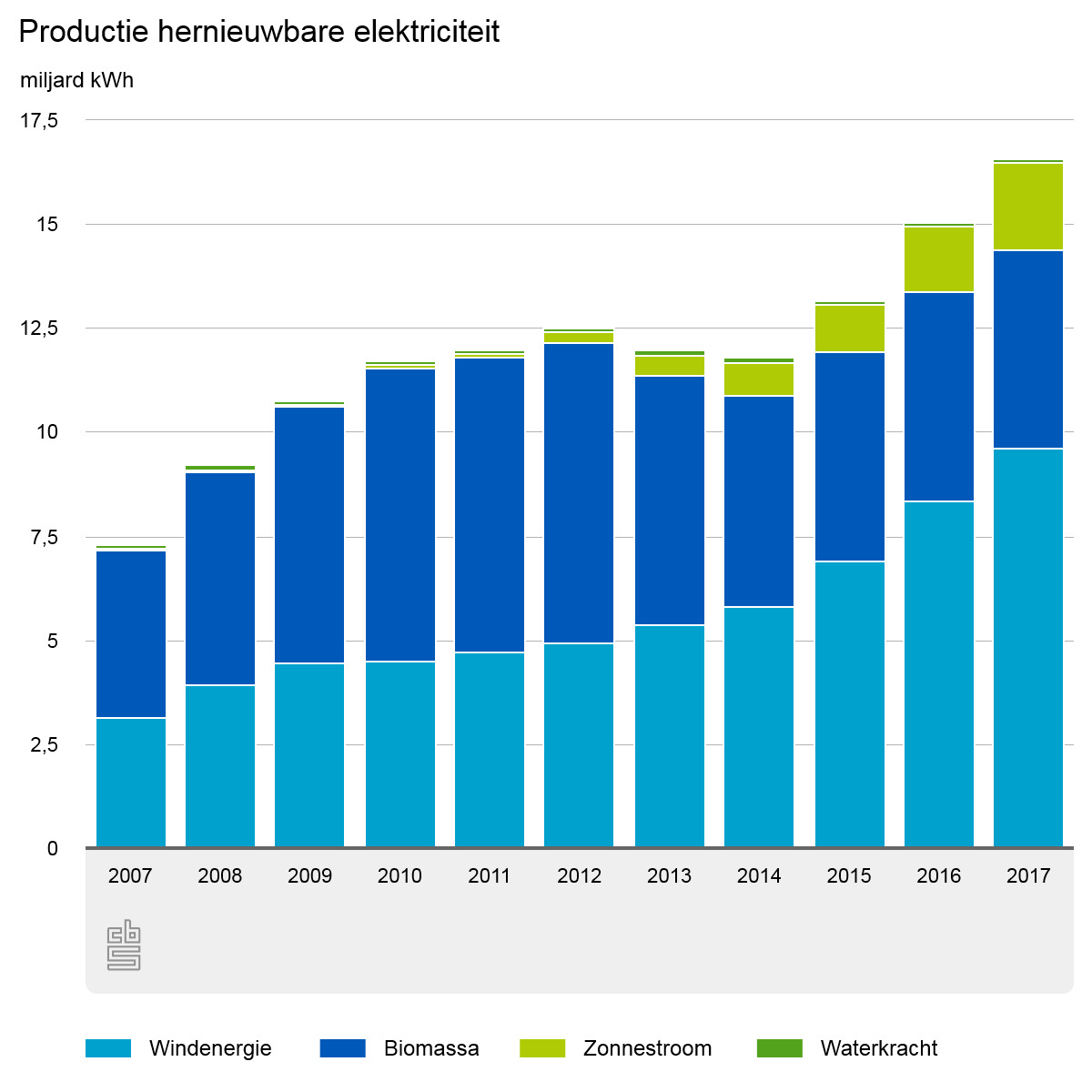

Figures CBS

The third group then consists of techno-optimists. For the sake of clarity, we also include ourselves in this group. The most important reason (for us at least) is simple physics: the sun emits approximately the same amount of energy per hour on earth as mankind uses in total for a year. Then it must be possible in one way or another to live on the earth without too much impact, even with the current energy consumption. The developments in technology go fast. Since 2015, the capacity of solar panels has doubled in the Netherlands and the growth seems to be picking up[7]. Efforts are being made to improve the efficiency of photosynthesis in order to solve the world food problem[8]. This week the first license was granted for a subsidy-free wind farm at sea[9]. The Dutch governmental coalition agreement has already made an indicative objective for each sector and further agreements are made on the climate tables. So here a strategic plan seems to be made[10].

What worries us as asset managers is that the value system with which we are going to assess solutions is not undisputed[11]. For example, is it only about CO2 or do the other environmental effects also play a role? Do we only look at the local effects[12] or do we also include the hidden impact on the rest of the world? And are we only looking at the prevention of global warming, or also at effective measures to deal with it? In other words, do we conduct a local or a global optimization? The nature of the sustainability issue is in principle global. Solutions will then have to be judged on their systemic impact in the long term with the entire earth as a system. If we have such an assessment framework, we can also get back to work as an asset manager. For example, we can deliver measures that seem to be good, but ultimately are counterproductive because of their hidden impact. Consider for example the maintenance induced failures, which every asset manager must have placed high on his attention list. But it is also simply about prioritizing measures. Some things may work, but only a very small amount, and then you could have spent the time and resources better on other things.

The developments that are now going on are therefore crying for answers in the area of ​​asset management. How will we include sustainability in the risk matrix, for example? And how does the balance between replacing and maintaining with life-span extension look like if you take sustainability into account? Which rules of thumb for sustainability can we now use as asset managers? All these questions are characterized by 2 aspects: assessment framework and long-term planning. Because we seem to have earned our spurs in both areas, we have decided to start writing again. We will share partial results with you through our columns. For the coming period you can therefore look forward to a series of publications, in which we will also touch taboos. We will try to build our answers from the basics so that everyone can calculate them themselves. Because we do not want to avoid controversial issues, we will pay more attention to the substantiation through sources. Nevertheless, we will not forget the relativating note. We also do not have the illusion that we will change the world, it is difficult enough to bring down our own impact. Nevertheless, we secretly hope to contribute to the national debate. At least until the summer, writing columns for us is sustainable asset management.

John de Croon and Ype Wijnia are partner at AssetResolutions BV, a company they co-founded. Periodically they give their vision on an aspect of asset management in a column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

[1] http://www.assetresolutions.nl/en/column/sustainable-christmas

[2] https://www.jobat.be/nl/artikels/top-tien-slechte-excuses-om-je-ziek-te-melden/

[3] https://www.ze.nl/artikel/213289-de-beste-smoesjes-om-niet-op-je-werk-te-komen

[4] https://www.tudelft.nl/evenementen/2016/tu-delft/04-apr/promotie-yc-wijnia-asset-management/

[5] https://www.zwollenu.nl/opening-station-stadshagen-afgeblazen-problemen/ : this is the last comment we make about rail in the winter of 2017-2018

[6] https://en.wikipedia.org/wiki/List_of_countries_by_ecological_footprint

[7] https://solarmagazine.nl/nieuws-zonne-energie/i15231/nationaal-solar-trendrapport-853-megawattpiek-zonnepanelen-geinstalleerd-in-2017

[8] https://www.volkskrant.nl/kijkverder/2018/voedselzaak/ideeen/het-antwoord-op-het-voedselvraagstuk-is-veel-sterkere-fotosynthese/

[9] https://www.nu.nl/economie-achtergrond/5184059/met-subsidieloos-windpark-zee-schrijft-nederland-geschiedenis.html

[10] https://www.rijksoverheid.nl/regering/regeerakkoord-vertrouwen-in-de-toekomst/3.-nederland-wordt-duurzaam/3.1-klimaat-en-energie

[11] http://www.mkatan.nl/nrc-columns/552-10-maart-2018-stem-en-geweten-van-de-wetenschap-het-geweten-van-de-wetenschap-de-stem-van-de-wetenschap

[12] See also https://www.thinkbigactnow.nl/en/ by Babette Porcelijn

<< back to overview

|