| |

Regret

31 August 2012 • Ype Wijnia

risk management, policy development, planning

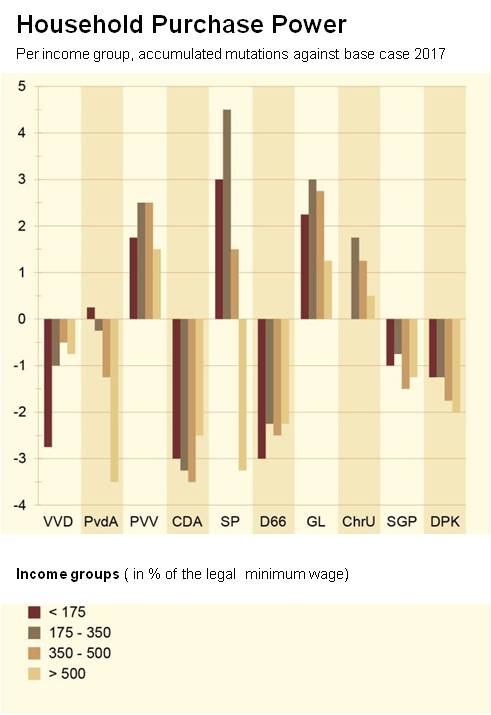

As the elections for parliament are approaching and given that the economic crisis is not over, the news is dominated by the effects the programs of the political parties would have on the economy[1]. An important contribution to that news was made by the publication of the model based prediction of the effects of the programs by the CPB[2], a Dutch econometric institute. The main comment in the publication was that there was something to choose. If the tables and graphs were reviewed, there are clear differences between the programs, for example on the development of consumer purchase power. The graph is shown below.

At first sight the differences are significant, as some programs score positive and others score negative. But if the scales are reviewed, then some relativism kicks in. Yes there are differences, but they are measured in percentages, not in orders of magnitude. Furthermore, the graphs show the accumulated differences over a 4 year period. Therefore even a score of -4 % is “only” a change of 1% per annum. Besides, the graph shows the difference to the base case, but how certain is that base case anyway? Fortunately, CPB also published about the uncertainty in the base case[3]. That graphs is shown below.

I presume the base case is the black line in the centre, which shows some minor growth until 2017. Given the worst outcome of the programs of -4% in 2017, that would mean a net result of 0 in 2017[4]. That does not sound very alarming, more like an acceptable risk. But what really interests me is the spread around the base case. In 2017 the score (in the 95% interval) can range from 97 to 115. This spread in what can happen to you is much larger than the spread in the options to choose from. And there is a probability that it may be much worse.

In itself it is not surprising in the open Dutch economy. We are strongly dependent on developments in the global market, nut much too small to influence the market directly. But it raises the question whether we are focusing on the right topics in the attention that is given to the political programs. Would it not be more advisable to think about the effects of the programs in the various scenarios that could happen? It is imaginable that differences between the programs change under deviating scenarios. Suppose that the environmental benefits of the program of the green party strongly depends on the economic growth, another program may score best given a prolonged recession. Would the worst case scenario materialize, a voter for the green party may regret its vote, as the other choice would have been better.

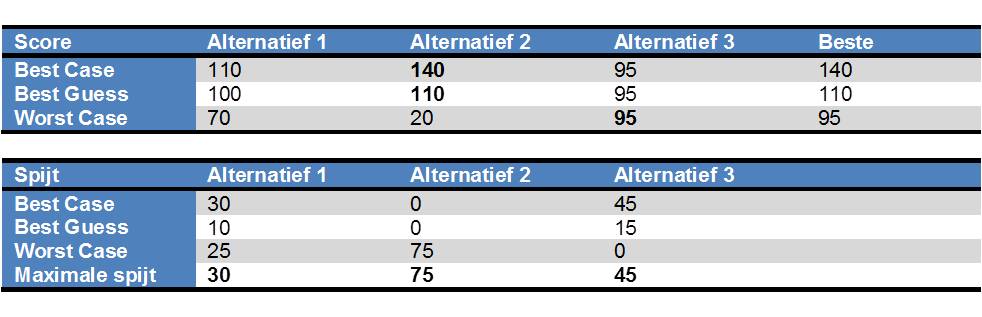

In decision sciences, the analysis of the regret of choices is a well known method. In this approach, the alternatives are compared under various scenarios. For each of the scenarios the best option is determined and for each the other alternatives the regret (= the difference between the score of the alternative and the best possible alternative under that scenario) is determined. The next step is to assess the maximal regret per alternative. The best alternative overall is the alternative with the lowest maximal regret, hence the name minimal maximal regret.

This operation is not entirely intuitive. Therefore the tables below contain a very simple example with 3 alternatives and 3 scenarios. As a reminder, an alternative is an option open for choice (in the elections the political parties) and a scenario a way in which the world can develop. TheBase Case is the expected development, the Best Case the most positive development and the Worst Case the most negative development.

In the given example, alternative 2 scores high both in the Base Case and in the Best Case, but very low in the Worst Case Scenario. Alternative 3 scores the same in every scenario, which results in the best score in the Worst Case scenario. Alternative 1 is not the best in any scenario. But looking at the regret of the alternatives, alternative 1 is most robust. Whatever happens, alternative 1 is never lagging far behind the best outcome, whereas alternative 2 is a bit of a gamble that the Worst Case Scenario will not happen.

Analysis of the minimal regret is therefore a method that may not result in top performance, but it is a method that results in agreeable outcomes over a wide range of scenarios. All we need right now is a spin-doctor that can turn the manifold use of the term regret into something positive.

Ype Wijnia is partner at AssetResolutions BV, a company he co-founded with John de Croon. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

[1] This column is partly about Dutch parliamentary culture, we apologize deeply if it does not make sense to any foreigner.

[4] This is under the assumption that economic growth is directly translated into Consumer purchase power, though in reality the relation may be much more indirect.

<< back to overview

|