| |

Predictions

13 June 2014 • John de Croon

risk management, policy development

Did you ever want to know how something develops in the future? You probably did. As asset manager you want to know what the future looks like and that is what this column is about.

It seems to me very useful to get an accurate prediction on traffic jams at least a day before I have to travel to a particular destination by car: where and when is a traffic jam and also how much is the delay. Then of course I want to know the best alternative route[1]. There are commercial parties which can make a paid prediction for you. With for example tarot cards a statement about the future is made. There are also people who are looking into a crystal ball and draw intelligent conclusions. We also have such a ball at home, which is located on the ceiling. I can already predict that in 99,9% of the cases the light comes on when I press the corresponding switch, but maybe I can also do the prediction without the ball of glass. However, a prediction on something like where and when a traffic jam is present or how the weather in the coming days will look like, I cannot make yet. Maybe I hit the wrong switch, or I use the wrong prediction technique. Now I've already discovered that others use supernatural powers: there are people who can discover patterns with a dowsing rod, astrologers can distract the state of the future by means of the stars and there are also hand readers[2]. On TV I saw soothsayers at work and it occurred to me that they asked quite suggestive questions so they got the required answers. Briefly, they are asking the wrong questions, though they will think differently. I am not so fond of these kind of predictions (or better: predictors).

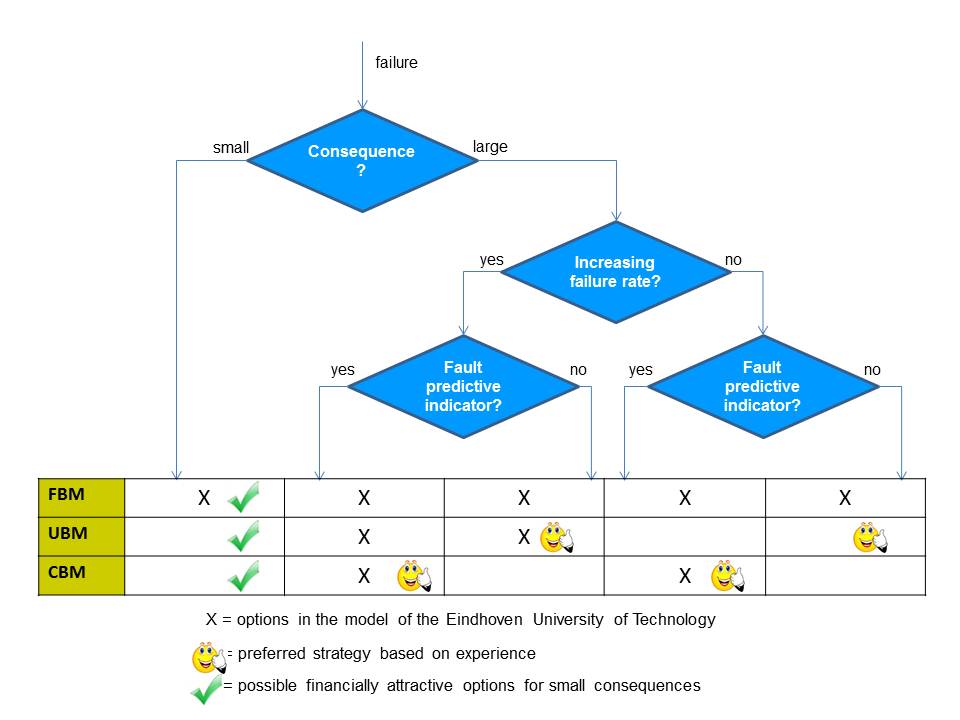

About a year and a half ago we put a test in a column of which we expected (so predicted) that someone would react[3]. In that column the figure (also shown here) shows that UBM and CBM could be attractive if the consequences are small. If the consequences are really small (so very small additional cost compared to preventive maintenance which would have prevented the failure from occurring, say 10%), then in 90% of the interventions you need to actually prevent a failure to be financially attractive. Then you should be able to predict very well. Although the column has over 100 'likes', nobody responded on this 'little test' to us. Didn’t our readers understand this? No, we do not believe this is the case. We have been a bit mean, by not asking for a response. Then it is not surprising that therefore there is no response.

In addition, asset managers are concerned with more serious predictions about future behavior of their assets. Nevertheless, we understand from asset managers that often making predictions is not easy.

Fortunately, science can help us to make predictions. Scientists sometimes perform substantive investigations, but for asset managers it is perhaps even more important science provides tools with which an asset manager can analyze himself. And of course, asset managers do so. Questions asset managers raise include ‘how long will the gas pipe last' or' what is the remaining life or sewers’. Many asset managers would like to spend a small fortune to get the answer. Statistical methods and techniques are applied which include significance, simulation, regression analysis, projections, hypothesis testing and error rates (and there is nothing wrong with using these methods and techniques, not at all!). Just look into your old lecture notes or school books for more backgrounds.

However, there is a pitfall. While often the soothsayers ask a question which is ‘quite not fair’, the question of asset managers in the examples mentioned before is not the right one (not to be confused with not fair!). You can calculate on life cycle models and sensitivity analysis and other statistical techniques until you get nuts, it does not give the forecast on where an asset manager is actually looking for. That is when the risk costs rise and exceed an undesirable level. Here, my colleague Ype already wrote about it[4].

In many types of assets you will not be able to predict the moment an asset fails very accurately in advance. Suppose however that you can do that, then it is questionable whether you can conduct a replacement just before for the failure moment. For example for an asset manager in the telecommunications, energy and water infrastructure, it can be required to excavate in the road and it is uncertain whether you get approval of the road authority for the moment just before the failure of the asset. If you get an approval, you will get awarded the full cost of getting the road into the required state again. Then it is probably more attractive to replace the asset earlier and share costs with other infrastructure managers because they also would like to replace assets. The same kind of logic applies to asset managers in the commercial sector: an asset manager of an ice cream factory could want to conduct a turnaround just before summer because the probability of failure is then unacceptably high, it is economically more attractive to do the job off season. So the answer of the question 'when is it economically most attractive' may be more relevant than the answer to the question 'when does my asset fail'.

The common thread in this column is to ask the right questions. Making a prediction can then be a lot easier, simply because it can be done with information which is easier to obtain and an answer can be found that is sufficient to take a decision. No dowsing, tarot cards or a crystal ball is required for that. Although applying these can still be a nice hobby.

[1] For those who want to point to the possibility of public transport: try it in an industrial area like Moerdijk or Botlek in the Netherlands.... then you can stay in a traffic jam quite a while (unfortunately)

[2] During my study period I could do that too, but after some alcoholic beverages that competence inexplicably disappeared

John de Croon is partner at AssetResolutions BV, a company he co-founded with Ype Wijnia. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

<< back to overview

|