| |

Portfolio decisions

11 May 2012 • Ype Wijnia

planning

In an previous column I advocated the abolition of the budget for asset management. The reason is that asset management decisions are to be regarded as investment decisions: if an expenditure has more benefits than costs, the expenditure should be financed no matter what. Though this principle still stands, there are situations in which some nuance is needed. But first, back to the originating idea, the situation that an asset manager should not let himself be restrained by the budget. The typical examples are on preventive and corrective maintenance. Let us presume the budget for corrective maintenance is not restrained. There is a prognosis (sometimes called the budget), but if an interruption occurs in the primary process it will be repaired no matter what, otherwise all income is gone and the business has to be closed down. Preventive maintenance on the other hand often is constrained. And that is strange indeed. If applied correctly, preventive maintenance provides more value (in terms of lost revenue and avoided repairs) than it costs. If you do not execute the preventive actions, you will get costs for repairs and outages that may fall in the same budget year. Take the example of a car that uses oil. Failing to top up the oil regularly because it is not budgeted will result in a total engine breakdown, costing much more. Those cost may be on the budget of somebody else (read: not the asset manager) but for the company as a whole it is a bad thing. My previous column was to confront this negative side effect of budgeting.

Yet, there are circumstances in which there is a need for constraining. First of all, the constraint does not have to be financial, but can also be a capacity problem. It can be valuable to do more on preventive maintenance. However, if there is a shortage in trained employees to perform the maintenance correctly, there is a significant risk in pursuing maintenance nevertheless. The untrained personnel may induce more failures than they prevent, for example by breaking things or reassembling them incorrectly. A second constraint can be if the benefits are not only financial, for example if measures are taken to improve safety, limit environmental impact and so on. Decision makers can attach a value to that (even a financial one in the willingness to pay) but those activities do not finance themselves. The money has to be earned by other means, and therefore the expenditure for those improvements is unavoidably limited.

Asset managers are confronted with both limitations. A good way of dealing with constraints is the portfolio decision. Portfolio decisions come from the financial realm. Financial asset managers manage a portfolio of financial assets (shares, bonds, options and other derivatives). The reason to manage portfolio’s instead of individual assets (i.e. shares in a single company) is that it spreads the risk. Share pricess of single companies can vary significantly at an average return. But not all shares will vary in the same way on the same moment[1]. By keeping a collection of shares, the average return stays the same (the expected value can be added) but the variability decreases and thus the risk. The asset manager tries to keep a portfolio that best matches the desired risk profile. If the risk profile of shares changes, the asset manager can replace them with other shares with a better matching profile.

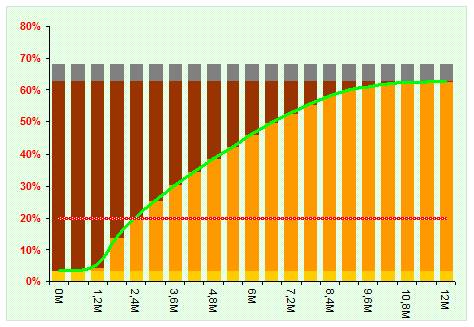

Being asset manager in the capital intensive industry, the approach will be more or less the same. The asset manager selects a set of projects and programs that best fit the risk profile the company desires. The diagram on below[2] shows the total benefit (over all values) the portfolio can produce given an increasing budget by allowing more projects that were ranked by their yield. This allows decision makers to select the right combination of costs and performance. However, there is a significant difference between the financial and the physical realm. Whereas an financial asset manager can choose amongst hundreds of exchanges with a myriad of tradable assets in parallel on every single moment, the physical asset manager will be confronted with projects on a one by one basis. To create an exchange like situation, the investment proposals have to be collected and stocked during the year, until the moment of the portfolio decision. That will not happen by itself and the asset manager will have to organize this.

But there are more differences. Asset managers will have to account for unavoidable expenditures, like failure costs (the flat first part of the green line). The third difference is the irreversibility of decisions. A project that is in execution can be stopped theoretically, but all money spend becomes a loss immediately. Changing the portfolio on a daily basis then becomes a very costly habit, a good reason to do it only once a year or to exclude those projects from the decision. Shares on a stock exchange can be sold without very high costs, and financial asset managers will update their portfolio on a daily basis. The last difference is that on the exchange the information on investment options is almost freely available (by means of historic price information), whereas developing a technical proposal costs time and money. To be able to choose, one has to spend effort on developing projects that will be rejected. It is clear that there is a limit to that.

Despite these differences, portfolio decisions can be a very powerful tool for the asset manager. Suppose a series of excellent project proposals has depleted the budget, but that some asset engineer came up with an even better idea. In a traditional approach (one by one decision making) that project either has to be postponed to the next year, or a project already approved has to be delayed. The portfolio decision offers the opportunity to select the best set of projects within a group of projects that by themselves passed the hurdle. In times of budget scarcity this can bring up to 20% of added value, almost without a cost. Another benefit is that projects are no longer measured against an abstract framework of business values, but are compared against each other. It may be easier to accept that the project was rejected because other projects performed better, than because an abstract criterion was not met. And finally, no business value framework is perfect, there will always be projects that do not meet the criteria but are nevertheless very important to the company. On an individual basis those arguments are very difficult to judge, as before you know it all projects may be exceptions to the rule. But if in a portfolio decision a small number of projects is marked as special and thus bypasses the business value framework, that is acceptable. It is even better than acceptable, as the availability of an escape can remove the pressure to exaggerate the benefits of the project in order to get it through the decision process. The portfolio decision thus becomes much more transparent and realistic. It then presents an opportunity to reach an agreement, instead of a battlefield on the approval of projects.

Ype Wijnia is partner at AssetResolutions BV, a company he co-founded with John de Croon. In turn, they give their vision on an aspect of asset management in a weekly column. The columns are published on the website of AssetResolutions, http://www.assetresolutions.nl/en/column

[1] The exception is when the variation is caused by an external event, like the credit crunch in 2008.

[2] WIJNIA, Y. C. & WARNERS, J. P. (2006) Prioritizing investment. The value of portfolio decisions in electricity infrastructure management. 29th IAEE Annual International Energy Conference 2006: 'Securing Energy in Insecure Times'. Potsdam.

<< back to overview

|